READ MORE

Don't want to pay the whole amount at once? Pay in instalments! In cooperation with Esto and Inbank, we offer the possibility to purchase all our products and installation conveniently in instalments. Read more about the instalment payment options and detailed terms and conditions for both Esto and Inbank below.

If you would like to pay in instalments, please contact us by phone +372 5568 9584 or email myyk@wmdcompany.eu.

FIRST PROGRAMME

ESTO instalments are a flexible payment solution that allows you to conveniently split your payment into monthly instalments. Conveniently spread the purchase amount over a period that suits you. You can choose the period and the amount of the instalment when you make your purchase.

How to use the ESTO hire purchase?

- Contact us on +372 5568 9584 or email myyk@wmdcompany.eu.

- Let us know that you would like to pay by instalment to ESTO.

- Choose your preferred repayment period between 3-60 months.

- Get a decision in real time.

- In case of a positive decision, digitally sign the contract with your ID card, Smart-ID or Mobile-ID.

ESTO hire purchase is offered and managed by ESTO AS. The annual percentage rate of charge for the hire-purchase credit from ESTO AS is 23.63%, based on the following model conditions: amount of credit 1490 EUR, cost of goods/services 1490 EUR, 0% down payment, fixed interest rate 11.90%, contract fee 0 EUR, total amount of credit and repayments 1844.64 EUR, assuming that the credit is repaid in equal monthly instalments of 76.86 EUR within 24 months. Please consult the terms and conditions before signing the contract and, if necessary, consult a specialist. The instalment facility is offered and managed by ESTO AS.

ESTO 3

ESTO 3 is the most popular new generation payment method. Conveniently divide your purchase amount into 3 equal parts. Get exactly what you need without interest, surcharges and deposits.

How does it work?

By choosing ESTO 3 as your payment method, you can split the total payment into 3 equal instalments over 3 months without any fees.

- Contact us on +372 5568 9584 or email myyk@wmdcompany.eu.

- Let us know that you want to pay by instalment for ESTO 3.

- Get a decision in real time.

- If the decision is positive, confirm the purchase.

- ESTO will send you your first invoice on the 15th of the following month.

The financial service is provided by ESTO AS. Before you sign a contract, you should read the terms and conditions and, if necessary, consult a professional. For more information, visit www.esto.ee.

WHAT IS ESTO?

ESTO is the preferred payment solutions provider in the Baltics, revolutionising the way merchants sell and consumers shop. ESTO has almost 500 000 active customers and over 3000 partner stores across the Baltics. ESTO's mission is to help partners sell and customers buy.

If you need help, contact an ESTO AS employee at info@esto.ee or visit. https://esto.eu/ee/kliendile-klienditugi.

INBANK INSTALMENTS

Inbank instalment facility allows you to turn a large one-off outlay into a small monthly expense and pay for products and services in instalments. Take more time to pay and spread the purchase amount over up to 5 years. The first payment is only due after a month.

Advantages of instalments:

- A flexible solution for larger outlays

- You choose the amount of the instalment

- You choose the hire-purchase period

- You choose the payment date

- Reply to a request in minutes

Terms and conditions for instalments:

- Amount 100 - 10 000 €

- Period 6 - 60 months

- Deposit 0 €

- Contract fee 0 €

- Management fee 0 € per month

- Interest 0% on the purchase amount, 10.9% from the 11th month onwards

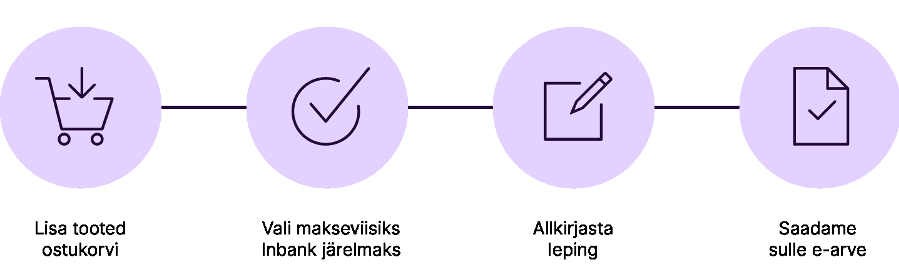

Applying for an instalment is easy:

Inbank's instalment credit cost rate is 0% per annum under the following sample conditions: instalment amount €500, contract period in months 10, interest rate 0% on the purchase amount, deposit €0, management fee €0, contract fee €0, monthly instalment €50, total cost of credit €500. The service is provided by AS Inbank Finance. Before concluding a contract, we advise you to read the terms and conditions of the financial service and, if necessary, consult a specialist.